PREMIER OFFERING: SPACE-X

SpaceX is a space payload delivery and satellite internet company.

Here are key stats for the business…

- Developer of first reusable space rocket (see 44 second video here)

- 60 successful launches in 2022 (no errors, next closest competitor launched 51)

- 3,300 of 12,000 satellites launched for satellite internet services to service 2.5 billion+ people without internet service (see www.starlink.com)

- $137 billion market cap as of Dec 2022 (#58 in S&P 500 if publicly traded, between AT&T and Qualcomm)

- $4.6b in 2022 revenue

We like the current entry point into SpaceX stock for the following reasons…

- Starlink, the company’s satellite internet business, is estimated to generate an additional $30 billion+ in annual revenue for the business. There are rumors that SpaceX will spin-out Starlink and IPO the business.

- SpaceX’s new rocket, Starship, is set to come online soon and has 3x+ the payload capacity of SpaceX’s current rocket (Falcon 9). This increased payload capacity will accelerate SpaceX’s market share gain from corporates and governments in the near to medium term.

- SpaceX’s superior technology and business moat has positioned it to capitalize on future monopoly opportunities like space manufacturing, space mining, and space travel.

5 year projected valuation…

- We estimate revenue to be $19.6b in 5 years (2028)

- This assumes (1) a 10% year over year increase in rocket launches baselined to SpaceX’s 2023 launch forecast of 100 and (2) a conservative 1.0m new Starlink subscribers per year

- SpaceX currently has a 29.8 revenue multiple that puts valuation at $584b in Dec 2028, a 3.17x gaiWe

AG Dillon – Pre-IPO Funds

AG Dillon & Co is venture capital asset manager offering passive, defined term pre-IPO stock funds.

Our goal is to…

- Provide pre-IPO stock market access to individual

investors - Execute trades at the best price with the best counterparty

- Return capital – and potential gains – as quickly as possible.

AG Dillon & Co currently offers three funds…

- AG Dillon Top 15 Pre-IPO Equity Fund

- AG Dillon SpaceX Pre-IPO Stock Fund

- AG Dillon OpenAI Pre-IPO Stock Fund

Investment Strategy

- Pre-IPO stocks

- Late stage venture backed companies (private market “large caps”)

- Passive / index-tracking

- Equally weighted

- 5yr defined term

- 15 holdings

- Buy, hold, immediately distribute

Stock Access

- Secondary shares through institutional traders

- Institutional traders: Forge Global, Zanbato, Nasdaq Private Markets, Goldman Sachs, Sharenett

Distributions

- Immediate after IPO or acquisition.

- If 5 year term expires and a pre-IPO company has not had a liquidity event that company’s shares will be sold in the secondary market and proceeds immediately distributed to LPs.

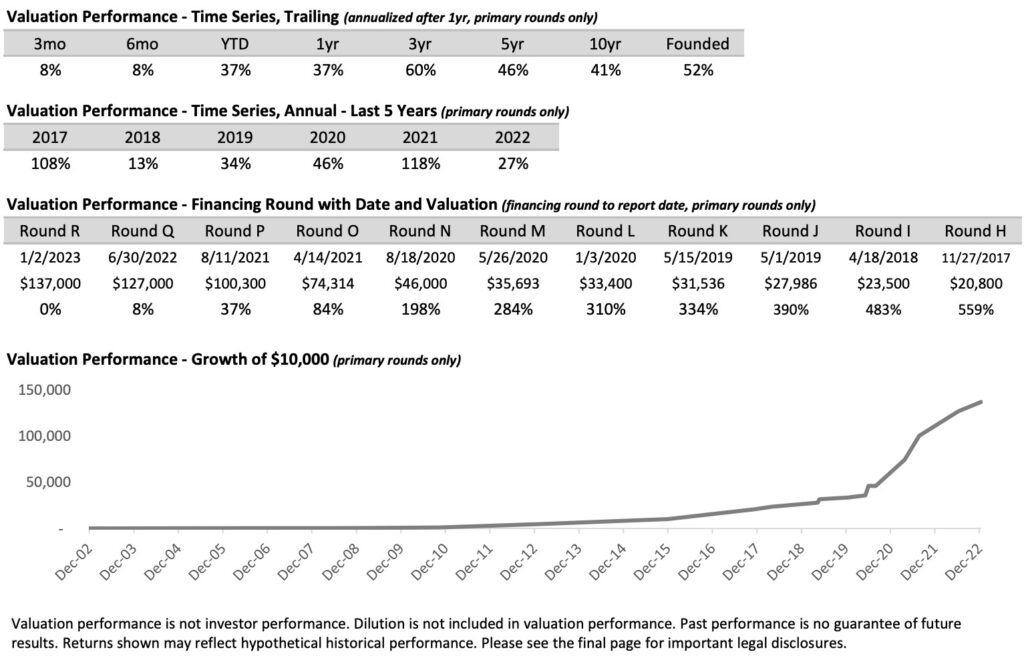

METHODOLOGY

- The index consists of quarterly vintages which are not rebalanced or reconstituted

- Private company valuations are based on material funding rounds led by venture capital firms.

- Secondary market transactions are not considered.

- Vintage calculation process

- Private companies must be included in Pitchbook

- Developed market companies only

- Backed by venture capital funds

- Raised capital in the last 24 months to qualify for inclusion in the index

- Negative news screen for company; fraud/crime issues, regulatory issues

- 15 largest companies selected by post-money valuation

Fees

GP

- 0.60% management fee*

- 10% carried interest

*Charged one-time upfront for full 5-year term

Fund

- Up to 5.00% broker commission (Forge, Zanbato, Nasdaq PM, etc)

- Fund administration by Nav Consulting

- Legal expenses by Morgan Lewis

- Variable fees for wire and blue sky filing

Meet the Team

FOUNDER & CEO

Dana Cornell

Dana Cornell is a Certified Investment Management Analyst and Certified Financial Planner, who’s passion is to take the uncertainty out of investing and provide consistent returns his clients can count on.

Dana has over 20 years of experience in the financial industry, and Cornell Capital was born out of a need recognized to truly create consistent, predictable income and wealth creation.

- Forbes Recognized 2021 Best in State Financial Advisor

- #1 Best Selling Author

- Creator of the “Reverse Financial Plan”

- Former Executive Director at Morgan Stanley

- 3x Named Forbes America’s Top Next-Gen Wealth Advisors

- Licenses Held:

- Series 7

- Series 63

Aaron Dillon

AG Dillon & Co

Managing Director

Dillon’s pre-IPO stock experience

- 5,500%+ realized return on SoFi pre-IPO stock investment

- 4,000%+ unrealized return on KraneShares ETFs pre-IPO stock investment

- 10 other pre-IPO stock investments including SilkFAW (www.silkfaw.com),

Public.com, Callin (www.callin.com), Kinly (www.bekinly.com), Paga

(www.mypaga.com) - Assisted 40+ fintech challenger banks launch online bank account offerings, assisted with seed capital raising (SoFi/Galileo, www.galileo-ft.com)

Dillon’s fund management and passive investing experience

- Co-founded KraneShares ETFs and ran day-to-day operations for SEC 1940 Act funds

- Head of wealth management division at FTSE Russell Indices and constructed indices for ETFs, direct indexing, and passive SMAs

Dillon’s regulatory and RIA/IBD servicing experience

- Managed investment product platforms at Morgan Stanley Wealth Management and TD Ameritrade and ensured

compliance with SEC and Finra regulation while understanding and meeting financial advisor needs.

Dillon’s companies and roles – see LinkedIn bio for more:

- SoFi – Managing Director – Wealth Management, Galileo division

- London Stock Exchange / FTSE Russell Indexes – Managing Director, US Wealth Mgmt

- KraneShares ETFs – Co-founder, Managing Director

- TD Ameritrade – Director, Head of Mutual Fund & ETFs

- Morgan Stanley Wealth Management – VP, Investment Products & Managed Accounts

All information is provided for information purposes only. All information and data contained in this publication is obtained by the AG Dillon & Co, from sources believed by it to be accurate and reliable. Because of the possibility of human and mechanical error as well as other factors, however, such information and data is provided “as is” without warranty of any kind.

No member of the AG Dillon & Co nor their respective directors, officers, employees, partners or licensors make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to the accuracy, timeliness, completeness, merchantability of any information or of results to be obtained from the use of the AG Dillon & Co Index Products or the fitness or suitability of the AG Dillon & Co Index Products for any particular purpose to which they might be put. Any representation of historical data accessible through AG Dillon & Co Index Products is provided for information purposes only and is not a reliable indicator of future performance.

No responsibility or liability can be accepted by any member of the AG Dillon & Co nor their respective directors, officers, employees, partners or licensors for (a) any loss or damage in whole or in part caused by, resulting from, or relating to any error

(negligent or otherwise) or other circumstance involved in procuring, collecting, compiling, interpreting, analyzing, editing, transcribing, transmitting, communicating or delivering any such information or data or from use of this document or links to this document or (b) any direct, indirect, special, consequential or incidental damages whatsoever, even if any member of the AG Dillon & Co is advised in advance of the possibility of such damages, resulting from the use of, or inability to use, such information.

No member of the AG Dillon & Co nor their respective directors, officers, employees, partners or licensors provide investment advice related to AG Dillon & Co Indices and nothing contained in this document or accessible through AG Dillon & Co Index Products, including statistical data and industry reports, should be taken as constituting financial or investment advice or a financial promotion.

Past performance is no guarantee of future results. Charts and graphs are provided for illustrative purposes only. Index returns shown may not represent the results of the actual trading of investable assets. Certain returns shown may reflect back-tested performance. All performance presented prior to the index inception date is back-tested performance. Back-tested performance is not actual performance, but is hypothetical. The back-test calculations are based on the same methodology that was in effect when the index was officially launched. However, back- tested data may reflect the application of the index methodology with the benefit of hindsight, and the historic calculations of an index may change from quarter to quarter based on revisions to the underlying economic data used in the calculation of the index.

This publication may contain forward-looking assessments. These are based upon a number of assumptions concerning future conditions that ultimately may prove to be inaccurate. Such forward-looking assessments are subject to risks and uncertainties and may be affected by various factors that may cause actual results to differ materially. No member of the AG Dillon & Co nor their licensors assume any duty to and do not undertake to update forward-looking assessments.

No part of this information may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without prior written permission of the applicable member of the AG Dillon & Co. Use and distribution of the AG Dillon & Co data requires a license from AG Dillon & Co.

Forward Looking Information: This page may contain forward-looking information relating to our business strategy and measures to implement strategy and other matters. Forward-looking statements are based on the opinions and estimates of management at the date the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements. We cannot guarantee future results, level of activity, performance or achievements and there is no representation that the actual results achieved will be the same, in whole or in part, as those set out in the forward-looking statements. We undertake no obligation to update or revise publicly any forward-looking statements except as required by applicable legislation.

Financial Estimates: This page may contain certain financial projections. We cannot guarantee future results, level of activity, performance or achievements. Consequently, we make no representation that the actual results achieved will be the same in whole or in part as those set out in the financial projections. We do not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any financial projections to reflect any change in our expectations or any change in events, conditions, assumptions or circumstances on which any such financial projections are based.

Securities Laws: This page is not, and under no circumstances is to be construed as, a public offering to sell or a solicitation to buy the securities referred to herein in any jurisdiction.

The information contained herein does not constitute an offer to sell nor is it a solicitation of an offer to purchase any security. Offers will only be made through a private placement memorandum to accredited investors and where permitted by law. Investments in the firm’s limited partnerships involve a high degree of risk, including the possible loss of your investment, and they are potentially illiquid with an uncertain liquidity date. Prospective investors should carefully review the “Risk Factors” section of any private placement memorandum.